Life on the West Island - Economics 101

03 March 2023

West Island economists – especially those in the Reserve Bank, federal treasury and The Australian Financial Review – cling ferociously to the belief that economics is an exact science. When they perceive that something is wrong with the national economy, they fervently believe that a little tweak here or there, or the pulling of some invisible economic lever, will produce a measurable result which will fix the problem. Perhaps because their lucrative careers depend on this being true, decades of such unsuccessful approaches to economic management do not deter them. Maybe they should heed a quote often attributed to Albert Einstein (although perhaps he was not the first to say it): insanity is doing the same thing over and over again and expecting different results.

Currently, we seem to have arguably insane economists running an obviously ineffective policy in a vain hope of reining in galloping inflation. It seems that such Western economists are still stuck in an era of Cold War-type thinking, where countries could be described as “good” or “bad,” depending on which side of the Iron Curtain they occupied. Or perhaps it goes back even further to the days of gangster and Wild West movies, when there were only “good guys” or “bad guys,” terminology favoured by former Prime Minister Tony Abbott. (Donald Trump was a good guy – anyone who disagreed with him was a bad guy who should be “shirtfronted!”)

At present, inflation has been placed in the “bad” basket, and the Reserve Bank is desperately pulling the interest rate lever to bring it down to its “preferred range” of 2-3%. So, it has raised interest rates nine times in a row in the confident belief that this will bring “bad” inflation down. Many other Western central banks have done the same.

And guess what? Inflation remains at 30-year highs – but the learned economists pontificate that it would have been much worse if interest rates had stayed low. Of course, our very own Reserve Bank governor promised that there would be no interest rate rises until at least mid-2024, because that would have been “bad.” Why do continue to pay attention to these so-called experts when they go on doing the same thing over and over and expecting different outcomes?

A big part of the problem is that the economists insist on putting economic factors into the “good” and “bad” baskets. But just consider for a moment – which of these economic measures are always good or bad?

Rising business profits |

Wage rises |

Rising house prices |

Inflation |

Growing exports |

Full employment |

Rising share prices |

Increasing imports |

Rising cost of living |

Taxes |

Community services |

Pensions |

Higher interest rates |

Boom or recession |

Of course, in all of these situations, there are always some winners and some losers. The Reserve Bank itself says that some inflation is good, but that levels that are either too high or too low are bad. Similarly, wage rises might sound good for workers but if (as at present) they are lower than cost of living increases, in real terms most people are going backward – and the same applies to many of the items on the economists’ good/bad lists.

However, there is a growing body of opinion on the West Island that the independent central bank is making things much worse for most citizens. For example, commentator Maeve McGregor recent asked: Does the RBA actually care about inflation or is it waging class warfare?

She continued: The Reserve Bank has long been spinning a dangerous and deeply confused narrative about its war on inflation. Since May last year, the central bank has raised interest rates sharply and in quick succession, crushing thousands of low- and middle-income households and pushing many more struggling families and individuals to the brink. The accepted wisdom is that this is not only an orthodox approach to inflation demanded by both the circumstances and the national interest, but one that, by design, unapologetically exacts a high human cost.

The hope is that the price of things will come down if people are forced to clamp down on their spending and economic conditions deteriorate. In this way, the consequences carried by higher interest rates are supposed to inspire some level of fear in employees by hanging the spectre of unemployment over their heads, frightening them into accepting real wage cuts as economically uncertain times roll on. The desired result is suppressed wage growth, lowered consumer demand and, eventually, controlled inflation — or so the thinking goes. The obvious problem, however, is that the inflation of today, for the most part, isn’t demand-driven.

Meanwhile, other experienced commentators point out the real root cause of rapidly rising costs of living for ordinary citizens. This is highlighted in a recent report from The Australia Institute: New empirical research reveals the main driver for inflation in Australia is excess corporate profits, not wages, and that inflation would have stayed within the RBA target band if corporates had not squeezed consumers through the pandemic via excess price hikes.

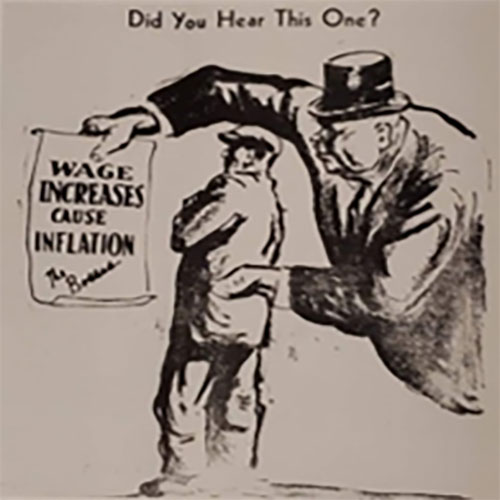

The dramatic expansion of business profits has gone mostly ignored by the RBA and other macroeconomic policy-makers, who have focused instead on a supposed ‘wage-price’ spiral which does not exist. This suggests the focus of the RBA on wage restraint is misplaced and unfair, and that interest rates would be far lower today if companies had not gouged customers at the checkout.

Senior economics writer Ross Gittins adds: The present inflationary episode has seen businesses large and small greatly increasing their prices. Although the rate of increase in wages is a couple of percentage points higher than it was, this has fallen far short of the 5 or 6 percentage-point further rise in consumer prices.

Put another way, big business profits are at record levels and wealthy executives and shareholders are lining their pockets, while ordinary West Islanders are being squeezed with rapid rises in the cost of living. Anyone for insane rampant capitalism?